Offit Kurman—The Better Way

Offit Kurman is one of the fastest-growing full-service law firms in the United States. With offices in nine states and the District of Columbia, Offit Kurman is well-positioned to meet the legal needs of dynamic businesses and the individuals who own and operate them. For nearly 35 years, we have represented privately held companies and families of wealth throughout their business life cycles.

In the past several years, we have grown by more than 50% through expansions in nine states and the District of Columbia. This growth has added to the depth of our capabilities and provided immense value to our clients.

Wherever your industry, Offit Kurman is the better way to protect your business, preserve your family’s wealth and resolve your most challenging legal conflicts. At Offit Kurman, we distinguish ourselves by our quality and breadth of legal services—as well as our unique operational structure, which encourages a culture of collaboration and entrepreneurialism. The same approach that makes our firm attractive to legal practitioners also gives clients access to experienced counsel in every area of the law.

What We Do

Offit Kurman provides clients with a comprehensive array of legal services that cover virtually every area and aspect of law. We are able to offer flexible rates consistent with—and often below—those of firms that handle comparable legal matters. This is because we are dedicated to offering clients the legal services they need in the most productive and cost-effective manner possible.

Offit Kurman serves a broad array of clients ranging from individuals and small, private corporations to multinational, public companies—both foreign and domestic. Our clients are primarily privately-held, middle-market businesses and their owners as well as nonprofit organizations and families of wealth. We also act as specialty counsel to institutional clients. A significant number of our clients operate internationally.

How We Do It

Who We Are

Brothers Maurice and Ted Offit, along with childhood friend Howard Kurman, started Offit Kurman as a boutique law firm in 1987. By 2001, the modest Owings Mills, Maryland-based firm began rapidly growing through affiliations with other small practices. It was at this time that Offit Kurman’s unique compensation system was put in place: the founders believe in rewarding people for the profit and productivity they bring to the firm, not their seniority.

It was also around this time that the Offit Kurman team realized they could grow at a sustainable pace through lateral acquisitions in strategic markets. To manage its growth, the firm brought on its first non-legal employees. Together, with the founders and several Practice Group leaders within Offit Kurman, these professionals soon formed a management committee and set an ambitious goal for the firm: to grow to 100 attorneys by 2010.

Offit Kurman’s attorney team continues to grow with more than 280 lawyers in 19 offices in nine states and the District of Columbia.

Diversity, Equity, & Inclusion

At Offit Kurman, DEI isn’t an initiative or a committee. Diversity, equity and inclusion are core values.

As Recognized By

News & Insights

Download our Legal Resources

Business Assessment & Diagnostics Solution

The Nine Most Common Estate Planning Mistakes

Intellectual Property Audit Review Checklist

Estate Planning Quiz: Are your affairs in order?

3 Keys to Making the Most of Your Advisory Board

When Fair And Equal Isn’t Fair And Equal

Ebook on Insurance Recovery for Policy Holders

Asset Protection Planning Video Series

Your Franchise: Getting In, Getting Out, And Everything In Between

The Cannabusiness Key Webinar

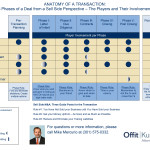

Anatomy Of A Transaction- Sell Side Infographic

Anatomy Of A Transaction- Buy Side Infographic

Anatomy Of A Transaction- The Business Combination Tornado Infographic

Mergers & Acquisitions: Withdrawal Liability Concerns