Offit Kurman - The Better Way To Practice Law

Professionals maximizing the value delivered to our clients.

Offit Kurman Attorneys At Law provides dynamic legal services to our clients. Our firm is well-positioned to meet the legal needs of dynamic businesses and the people who own and operate them.

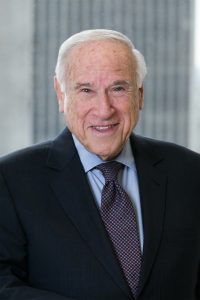

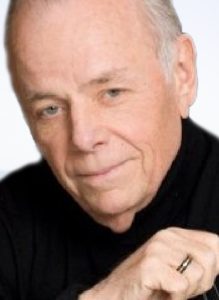

Learn more about each of the members of our legal team or get in touch with an attorney by visiting the profiles below: